How To Create Epf Account Online

The UAN, short for Universal Account Number, is a 12-digit unique number issued to every employee contributing to the EPF (Employee Provident Fund). When a person is employed for the first time, the employer has to get the UAN generated for him. The criteria for the company to generate UAN is that the organization has to have 20 or more employees.

In case an employee has been assigned with a UAN number in the previous organization, he/she has to share the details of the same with the new employer before a new UAN gets generated.

How To Generate UAN?

In order to get a new UAN generated for the employee, the employer has to follow these steps:

- The employer needs to Login into EPF Employer Portal or UAN Login portal here using the Establishment ID and password

- After EPFO UAN account login , Go to the member section and click on the "Register Individual" option

- Enter the employee's personal details such as PAN, Aadhaar, bank details, etc.

- Then the employer needs to approve all details in the "Approval" section.

- A new UAN is finally generated by EPFO and the employer can now successfully link the PF account with UAN of the employee using other services of the PF UAN Login Portal

How to Activate and Login to the EPFO Website Using UAN?

Please note for UAN number registration, you must have your UAN and PF number with you. The online UAN Activation process has the following steps:-

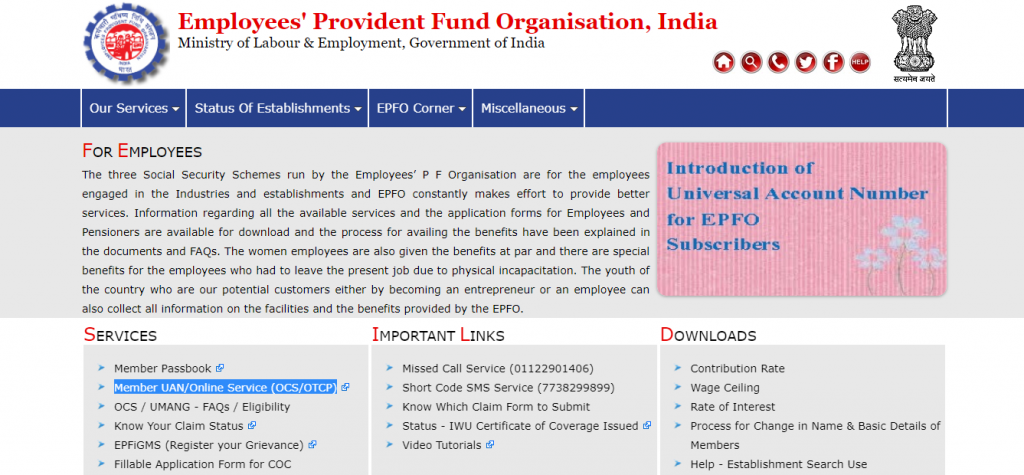

Step 1: Visit https://www.epfindia.gov.in/site_en/ and then click on our " Our Services". Under that select " For Employees".

Step 2: Select " Member UAN/Online service s " under the services section. With this, you will be able to enter the UAN Portal.

Step 3: Enter the required details like UAN, PF member ID and your mobile number. Enter the correct Captcha code and then click on "Get authorization PIN Button". The PIN will be sent to your registered mobile number.

- Tick the " I agree" checkbox under disclaimer. Enter the OTP that was sent to you earlier and click on " Validate OTP and Activate UAN".

- Upon EPF UAN registration, a password will be sent to your registered mobile number, which you can use to access your epf account.

What are the Documents Required for UAN Activation?

Following documents have to be provided at the time of UAN Activation

- Aadhaar card

- PAN card

- Bank account details and IFSC

- Any other proof of identity or address, if required.

How To Link Aadhaar with UAN and PF?

Online Mode

To link Aadhaar with UAN and PF Online follow the steps below

Step 1: Log in to the EPFO Portal / UAN Member Portal , click on "For employees" and then click on 'UAN Member e-Sewa".

The link to reach the EPFO Portal is : ( https://unifiedportal.epfindia.gov.in/ )

Step 2: Enter Universal Account Number and password to login to the portal. Enter the captcha and click on Sign In.

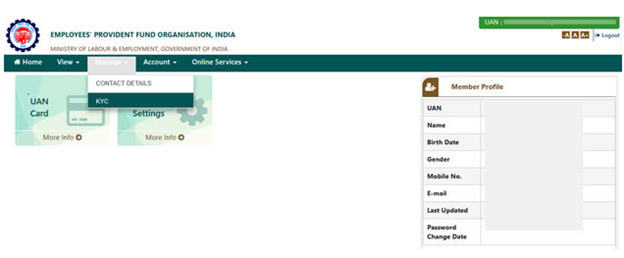

Step 3: Once you enter the portal, select " Manage" from the title bar and then select "KYC".

Step 4: As you move to the next screen, under "Add KYC Tab", enter your bank, PAN, Aadhaar, passport, driving license, election card, ration card etc details and submit them. Once you submit the details you will be able to see them under the "Pending KYC" tab. Your employer will take about 15 days to approve the details provided by you. Once it is approved, you can see the information under" Approved KYC" tab.

Offline Mode

EPFO has also provided the option to link Aadhaar number and EPF account offline. This can be done via an Aadhaar linking application developed by EPFO where the employee is required to fill the application and provide details of UAN and Aadhaar number.

Self-attested copies of UAN, PAN and Aadhaar are required to be furnished by the employer along with this form. The above-mentioned form and documents have to be submitted at the field offices of EPFO or Common Centre services.

Upon completion of verification, the Aadhaar number will be linked to the EPF account. A message regarding the same will be sent to the employee's registered mobile number.

UAN Activation – FAQs

Ques . Who has the authority to allot UAN?

Ans . The Employee Provident Fund Organisation (EPFO) allocates the UAN for each PF account holders.

Ques . Can an employee have two UANs allotted under a single name?

Ans . No, an employee can only have one UAN allotted under a single name which is transferable across all eligible employers.

Ques . What is the procedure to update personal details in UAN?

Ans . Employees need to submit their updated details to their employers which will be verified and sent to the concerned officer. After successful verification, the information will be updated in the UAN portal.

Ques . What is the use of listing all previous member IDs in the Universal Account Number?

Ans . The purpose of the Universal Account Number is to consolidate Member Ids (multiple Member Identification Numbers) that were allocated to a single member. It is useful in checking all the Member IDs of an employee and further enables to check eligibility for online transfer of PF amounts. However, as per the new proposed changes, members would need to disclose their previous Member IDs or UAN to the new employer in Form-11.

How To Create Epf Account Online

Source: https://groww.in/p/savings-schemes/uan-registration/

Posted by: pepperhisday.blogspot.com

0 Response to "How To Create Epf Account Online"

Post a Comment